Gen X Women and Financial Advice

In recent years, there has been much attention to the growing gender Superannuation gap, with women lagging far behind men in retirement savings.

There are a few factors contributing to the gender Superannuation gap:

Pay Gap. As Superannuation contributions are linked to salary, the more you earn, the more you will have in your Superannuation. According to the Australia Institute's Centre for Future Work, Australian women earn $1.01M less over their working lives than men.

Part-time work. Women are more likely to work part-time, commonly due to family and child-care commitments.

Early retirement and longer life expectancy. Women tend to retire seven years earlier than men on average, giving less time to accumulate savings. Women also tend to live longer, creating a need for more funding in retirement.

Career breaks. Women often experience more career interruptions due to family caregiving commitments.

More risk averse. Women tend to be more risk averse than men and may choose to remain in more conservative investment options.

Though women may be more exposed to the dangers of underfunded retirement, most Australians are not very confident they will have enough resources to have a comfortable retirement.

Some of the costs of underfunded retirement may be:

Needing to keep working to meet the desired lifestyle

Needing to rely on government support such as the Age Pension

Inflexibility of lifestyle

Often people do not seek financial advice as they feel it will be too expensive or are not thinking about their long term finances. The benefits of financial planning for retirement are:

Having a clearer picture and timing of what retirement could look like

Putting in place a wealth creation strategy that is diverse and personalised

Tax and investment optimisation

Guidance in financial decisions and a better understanding of risk, trade offs and benefits.

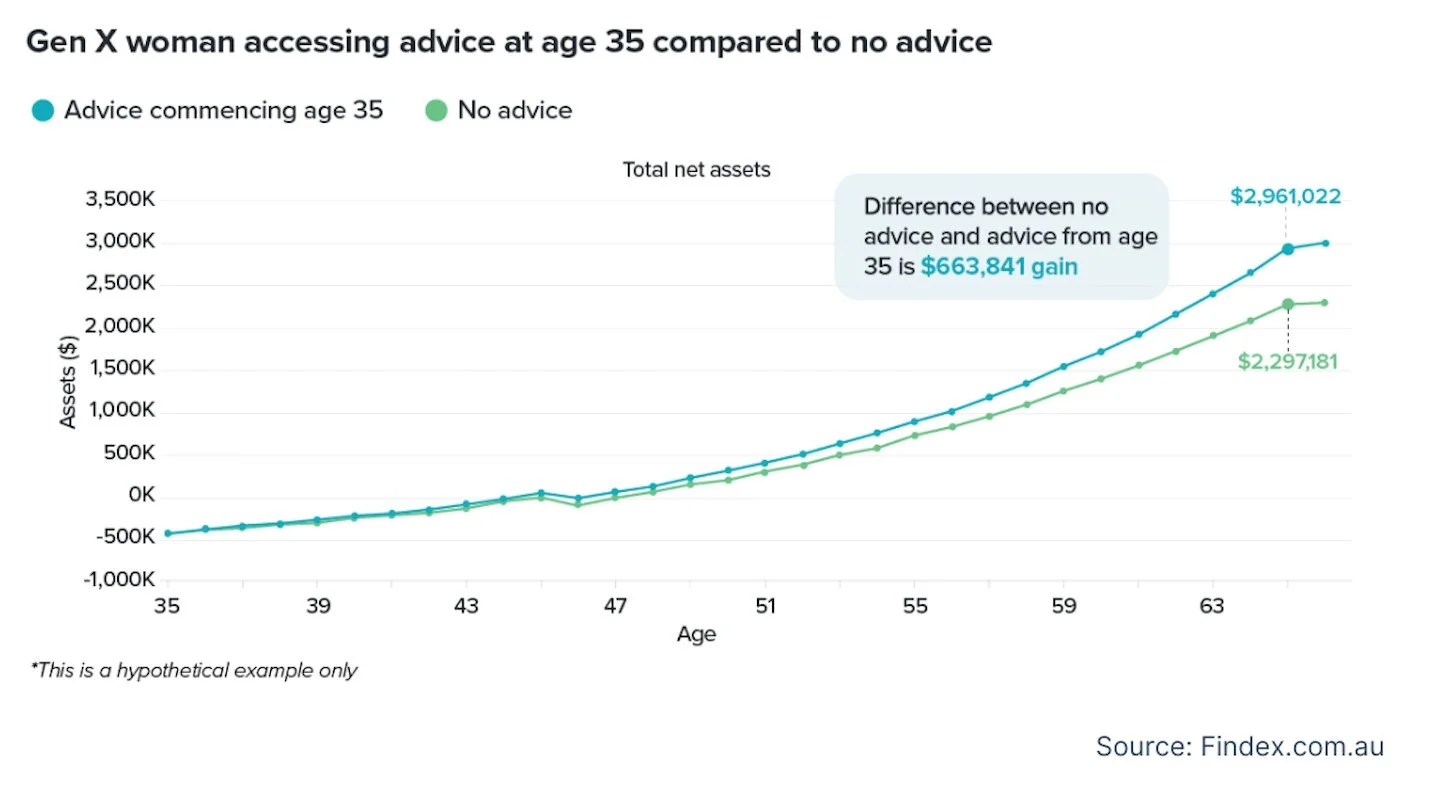

Using financial modelling based on a set of assumptions, the graph below shows a woman earning $100,000 p.a. and accessing wealth management advice in her mid-30s could grow her net financial assets to an estimated $664,000 more than if she doesn't access financial advice.

Engaging early with financial advice empowers you to maximise your financial resources. Compounding returns and accumulative tax savings can yield substantial benefits. Our financial advisers will tailor financial strategies based on your income, expenses, risk tolerance, and long-term objectives.

There is no fee for your initial meeting, so please contact our office and make time to plan your future and retirement with one of our financial advisers.

For specific financial advice, please contact your Bongiorno Financial Adviser.