Superannuation contribution catch up

From 1 July 2018, if you have a total super balance of less than $500,000 on 30 June of the previous financial year, you will be able to carry forward your unused concessional contributions cap.

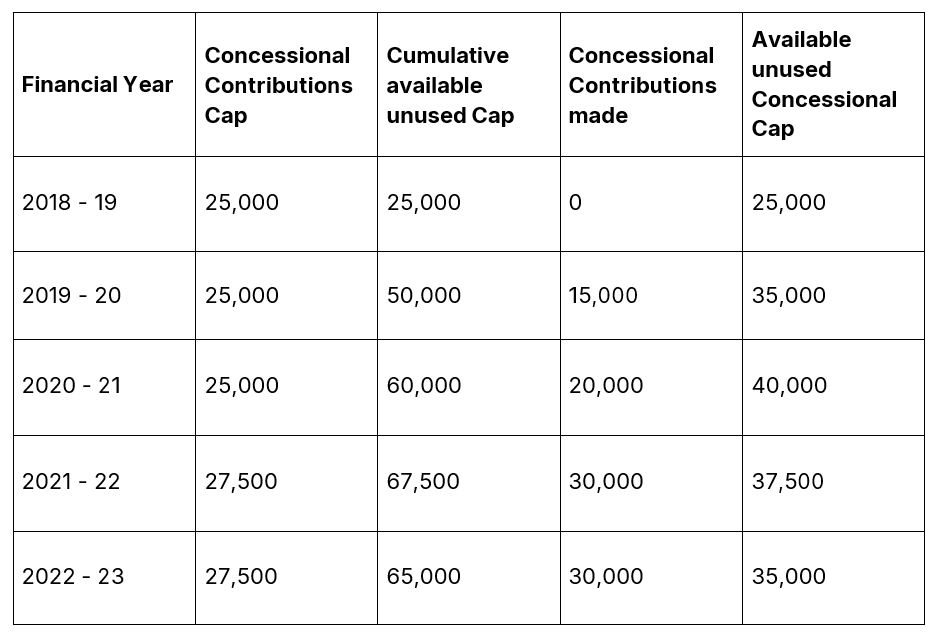

Unused cap amounts can be carried forward for up to five years. An example of how the unused cap amounts carry forward is shown below:

Please contact your adviser if you wish to discuss the superannuation catchup further.

Please note: This is the last year you can utilise your unused carry forward concessional cap from 2019.

If you have any questions, please contact us.